The autumn congress of Eucolait, Europe’s dairy trade association, of which Foodcareplus is a member, took place on 24 September. The congress discussed the trends in the global dairy trade from Europe’s perspective. Various expert speakers shared key insights, and the dairy team at Foodcareplus reflected on what this means for import, export, and international shipping.

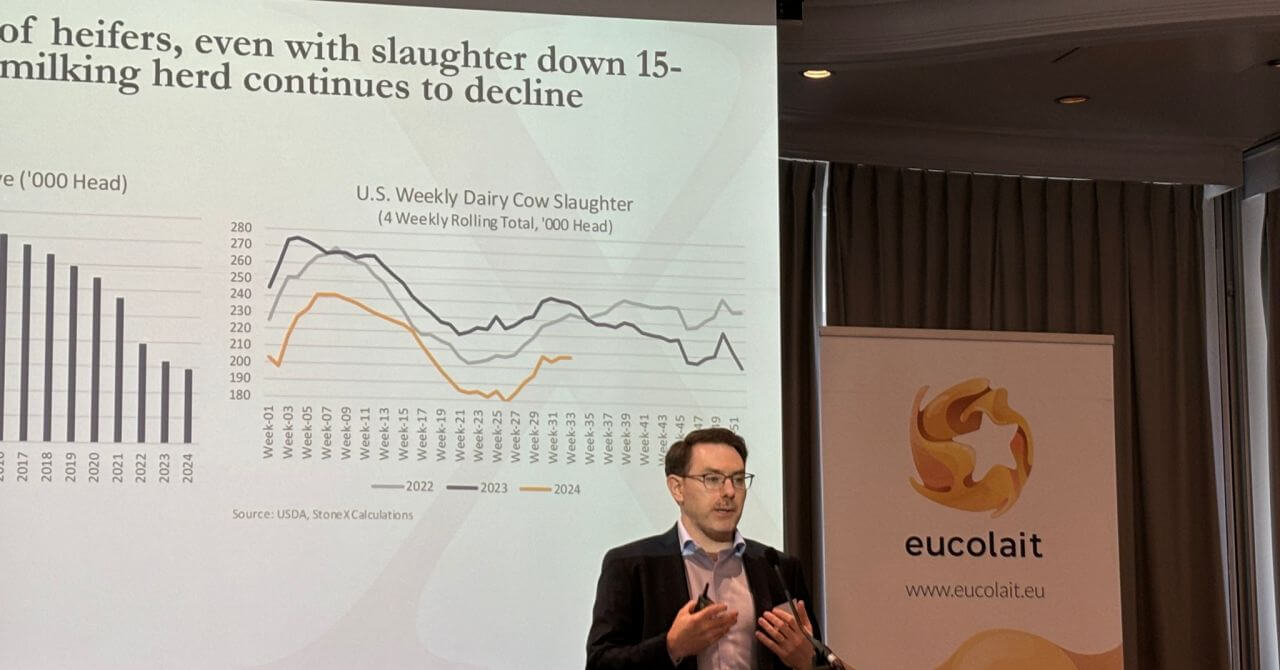

Decreasing herds but increasing production yields despite diseases

The inflation and economic uncertainty in Europe, particularly in Germany, make dairy producers look to diversify their export destinations to decrease overreliance, and cheese and butter export volumes validate that. However, those involved in dairy exports must monitor cost trends observing labor and energy costs. The current high milk prices and reduced feed costs, at the same time, will motivate production while herds are decreasing and yields are increasing. We must watch how blue tongue and avian influenza are pushed back to keep production going.

At Foodcareplus, we currently observe favorable reefer container availability in Europe for most trades and do not expect that to change in the next quarter. At the same time, the strike ended on the East Coast of the United States, potentially damaging cheese exports due to cost hikes and service interruptions.

China continues to decrease dairy imports

While Europe and China are discussing electric vehicles and WTO probes are under investigation for pork and other food products, China is increasing self-reliance on milk powders and potentially becoming a future exporter competing with European exporters.

Even with all-time low freight levels for milk powders into China from Europe, exporters must proactively explore alternative destinations such as Southeast Asia and Africa to compensate for the expected continuous drop in Chinese demand. Although the freight market to Africa is more challenging than other markets, eastbound freight to Southeast Asia is just like China at deficient levels, allowing European traders to position themselves competitively in the global market.

Foodcareplus expects the freight rates for milk powders to remain stable and competitive in most markets east of Suez. Instead of playing the spot market card, it might be a good time to lock in some rates for West Africa for the next quarter.

Ukraine or India?

Despite the logistical challenges of moving dairy products out of Ukraine, the country’s integration with EU infrastructure presents new shipping and overseas opportunities. Ukraine is positioning itself, and given its agricultural strength, it will play a role in the future dairy trade. The Romanian port of Constanta is experiencing growth, while the Polish ports are still a viable gateway for destinations crossing the Atlantic.

At the same time, India is, like China, putting itself on the map and might take a piece of the (cheese—) in the future global milk powders trade. No matter what, Foodcareplus can assist traders seeking to ship out of India and the two Ukraine port gateways.

Foodcareplus offers comprehensive intermodal and cross dock solutions for dairy from various Eastern European countries while our Indian partnership allows dairy traders to manage shipments from India to their global markets.

Pizza rules, and say "cheese."

Everyone at the congress agreed that global cheese demand drives new export opportunities. This rising demand in emerging markets is primarily through fast-food sectors like pizza chains. Wherever it is produced in Europe, Foodcareplus can assist its dairy network in moving frozen and chilled cheese, whether or not cross-docked depending on the distance from port gateways, into the major destinations.

Foodcareplus offers private consolidation services for it’s trading customers shipping dairy products from different European suppliers to their overseas markets.

Contact Dina Fayad for more information.